If so, you may want to consider a home equity loan (or) line of credit.

Credit card & personal loan interest rates are currently above 22.00% APR in the US today and continue to move higher. You can save thousands of dollars by consolidating your debt into a low-interest rate 2nd mortgage.

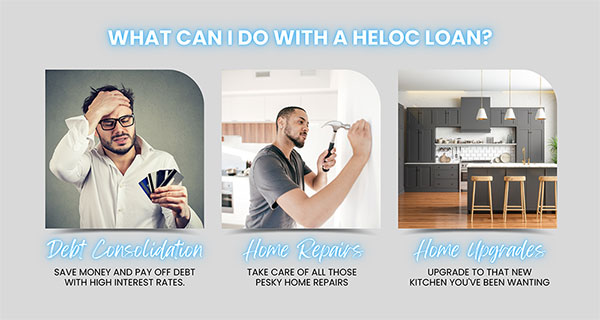

Access the equity in your home for debt consolidation, home improvement (or) any other purpose without refinancing your low-interest rate 1st mortgage.

CalTAP PLUS HELOAN

Home Equity Loan (2nd Mortgage)

CalTAP PLUS HELOC

Home Equity Line of Credit (2nd Mortgage)

If you are ready to obtain a home equity loan or line of credit, please give us a call (or) apply online with confidence that you will receive the “BEST” combination of rate, pricing and overall customer experience with Secure Choice Lending.

*Click here to view disclaimer for Keys in 21 Days, Free Rate Float Down & MATCH (or) BEAT Guarantee.